2024 20 Business Deduction Amount

2024 20 Business Deduction Amount – Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. . In short, a credit gives you a dollar-for-dollar reduction in the amount of exclusively for business-related activity, the IRS lets you write off certain home office deductions for associated .

2024 20 Business Deduction Amount

Source : m.facebook.comHow did the Tax Cuts and Jobs Act change business taxes? | Tax

Source : www.taxpolicycenter.orgThe Best Receipt Scanner Apps to Manage your Business Expenses in

Source : www.fylehq.comZ5 Marketing

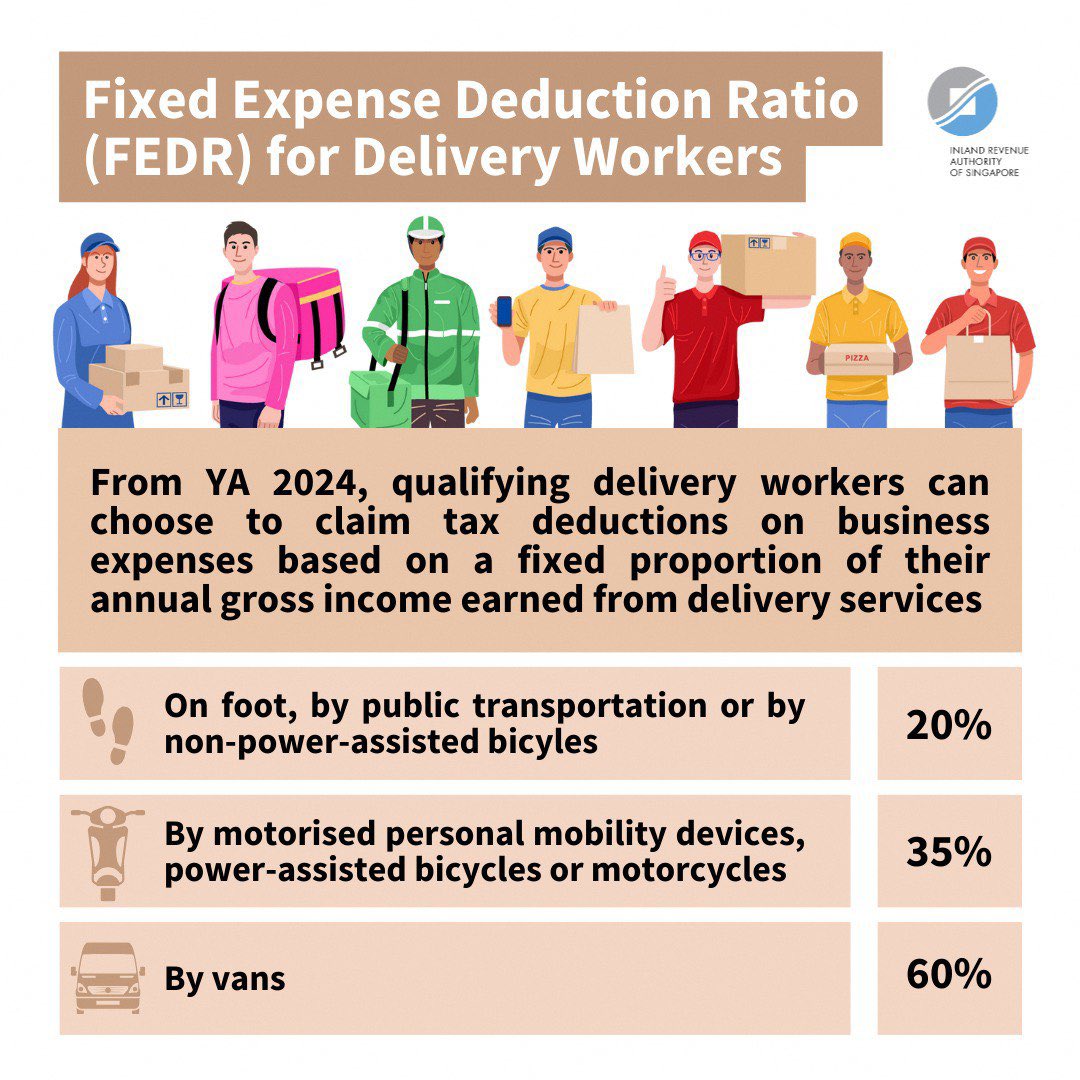

Source : m.facebook.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comMcDaniel & Associates, P.C. | Dothan AL

Source : m.facebook.comThe Livestock Conservancy on X: “https://t.co/NmxfMZLpoS” / X

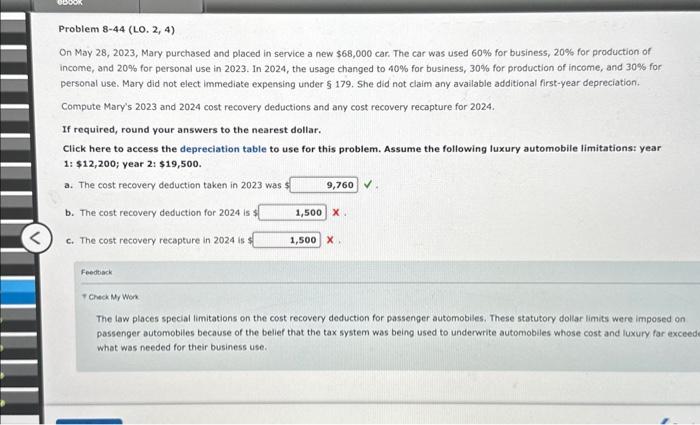

Source : twitter.comSolved On May 28,2023 , Mary purchased and placed in service

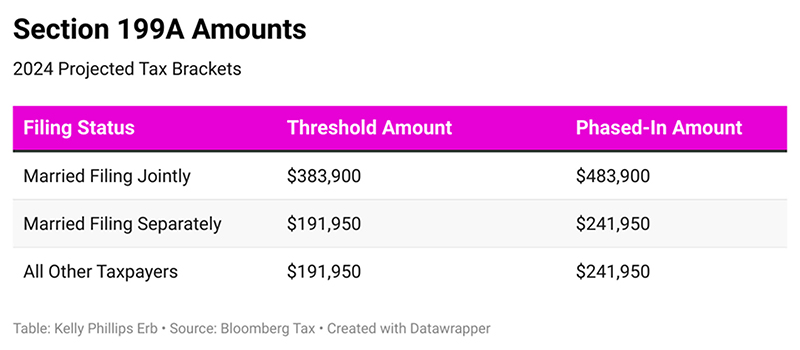

Source : www.chegg.comYour first look at 2024 tax rates, brackets, deductions, more

Source : kmmcpas.comPenn Township approves 2024 budget | Chester County Press

Source : www.chestercounty.com2024 20 Business Deduction Amount Merline & Meacham, P.A.: ($17,500 – $3,500 = $14,000) This reduced amount of the SEP IRA This would include business owners who can’t claim the 20% QBI deduction anyway, which would be for high-income business owners . Keep more money in your pocket with these money-saving tax deductions you can take as a small business owner. Keep more money in your pocket with these money-saving tax deductions you can take as .

]]>